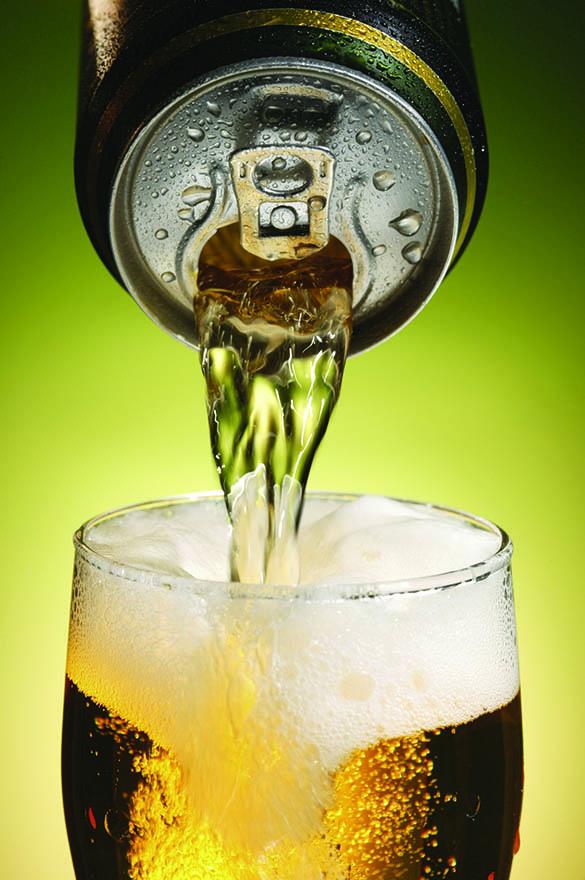

Craft Beer Packaging

This includes a variety of craft-style beverage categories that continue to skyrocket in terms of consumer demand and are expected to continue capturing market share.

Craft Beer

Crown recognized the potential of the craft beer industry early on and has helped countless breweries expand their reach to consumers with innovative beer packaging. There are several factors driving the adoption of the craft beer can by the craft beer industry, including the inherent barrier properties that protect freshness and taste and printing techniques that enable brands to express their unique identities. Case in point: The Society of Independent Brewers (SIBA) Craft Brew Report 2022 indicates that the volume of its members’ craft beer going into cans has more than tripled since 2019.1

Like every industry, the craft beer market was impacted by the pandemic, but it seems to be on the rebound. For example, in the U.S. in 2021, overall U.S. beer volume sales were up 1%, while craft brewer volume sales grew 8%. This increased small and independent brewers’ share of the country’s beer market by volume to 13.1%, up from 12.2% the previous year.2 The figures mark a return to pre-pandemic norms when craft beer growth outpaced the overall beer market. In Europe, SIBA member breweries saw average production recover in 2021, after a dramatic fall in 2020, but it remains below 2019 levels.3

2 https://www.brewersassociation.org/statistics-and-data/national-beer-stats/

Customer Success Stories

In the Market

Raise a Can for National Beer Day

Craft Brewers Get a Taste of Seaming and Can Design

Designing Desirability Series: The Benefits of Metal Packaging

Crown And BrewDog Bring Scottish Craft Beer To Cans

Questions for Crown?