New Can Manufacturers Institute Report Shows How the Can Industry will Meet Its Ambitious Recycling Rate Targets

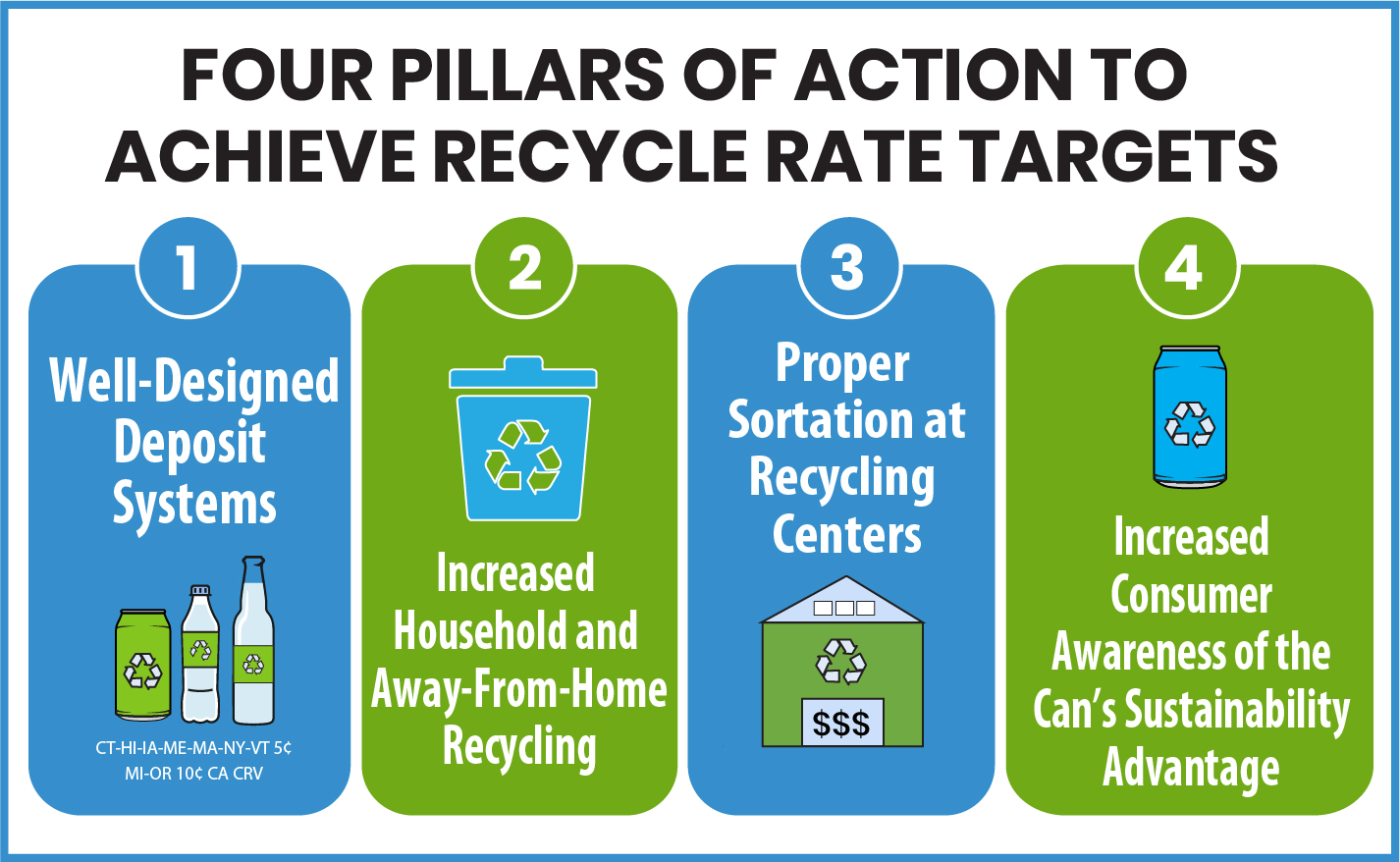

Four Pillars of Action to Achieve Recycle Rate Targets

|

PILLAR NUMBER |

ACTION |

|---|---|

|

1 |

Well-Designed Deposit Systems |

|

2 |

Increased Household and Away-From-Home Recycling |

|

3 |

Proper Sortation at Recycling Centers |

|

4 |

Increased Consumer Awareness of the Can's Sustainability Advantage |

WASHINGTON, DC (July 12, 2022) – Can Manufacturers Institute (CMI) published today a detailed aluminum beverage can recycling primer and roadmap that explains how the ambitious U.S. aluminum beverage can recycling rate targets that CMI members announced in November 2021 will be achieved. Those targets are reaching a 70 percent recycling rate by 2030, 80 percent by 2040 and 90 percent by 2050. This new report provides more details on what the can industry is doing in the near-term within its four pillars of action to make progress toward the targets and the potential total used beverage cans (UBC) that could be recycled through certain pillars.

The aluminum beverage can is the most recycled beverage container in the United States with a 45 percent recycling rate in 2020. The U.S. aluminum beverage can industry knows improving upon that leading position by achieving the targets will not be easy but will have a significant impact. Consider that in 2020, for the aluminum beverage can recycling rate to have reached 70 percent, 25.6 billion more cans needed to be recycled. If the target had been met and those additional cans recycled, it would have generated more than $400 million in revenue for the U.S. recycling system and resulted in energy savings that could power more than 1 million U.S. homes for an entire year.

The report explains in detail how CMI will achieve its targets via four pillars of action, which are:

- Catalyze the passage and implementation of well-designed deposit systems at the state and federal levels.

- Increase and improve household and away-from-home recycling.

- Ensure that more cans are properly sorted at recycling centers.

- Increase consumer understanding on the importance of aluminum can recycling and the ability to collect and sell used beverage cans for cash.

This report provides new data on the potential impact of certain pillars. For example, if there was a national deposit system that had recycling rates similar to a state such as Michigan where there is a 10-cent deposit, an additional 50 billion aluminum beverage cans would be redeemed through the deposit system and ultimately recycled. This pillar has the greatest potential impact and would allow the industry to quickly reach its goals. This is part of why CMI is aggressively pushing for new, well-designed deposit systems.

CMI modeling also finds that 23 billion additional aluminum beverage cans could be captured from U.S. households if they all went from their current level of recycling access to having automatic, cart-based curbside recycling service with robust education. This number was calculated based on data from The Recycling Partnership (The Partnership). CMI was a founding member of what ultimately became The Partnership and is continuing its general support of the organization so it can continue its work to increase and improve household recycling.

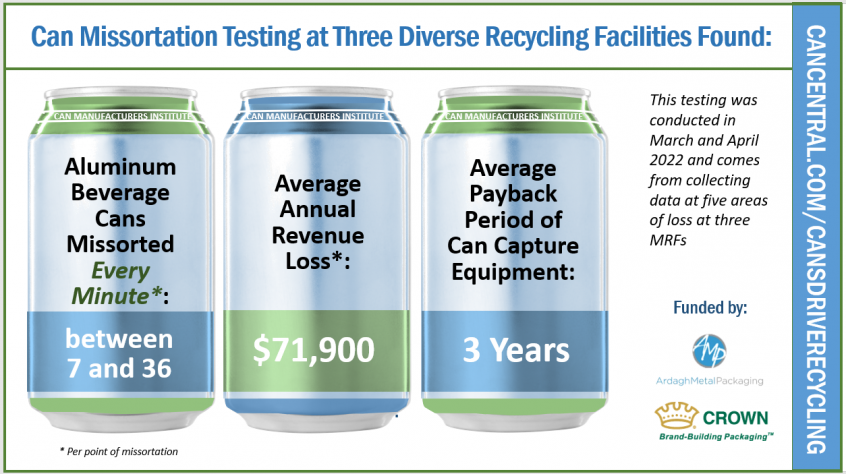

If there was perfect sortation at recycling centers, an estimated 3.5 billion additional aluminum beverage cans could be collected for recycling. CMI issued a report in 2020 finding that up to one in four UBCs are missorted at material recovery facilities (MRF), which is where single stream recyclables are sorted. Last year, with the financial support of Ardagh Metal Packaging and Crown Holdings and in conjunction with The Partnership, grants were awarded to five MRFs for can capture equipment that when installed will capture 71 million aluminum beverage cans per year. Ardagh and Crown are continuing to fund activities through CMI to catalyze additional can capture equipment in MRFs including testing at MRFs of exactly how many cans are being missorted and developing a return on investment (ROI) calculator that was published online for any MRF to use at no cost to determine the ROI of investing in can capture equipment in its facility.

“This new report makes clear the opportunity to make progress on our ambitious U.S. aluminum beverage can recycling rate targets, and the steps CMI members are taking in each pillar of action right now to make progress within those pillars,” said CMI Vice President of Sustainability Scott Breen. “We encourage stakeholders to read the report, understand how the targets and their associated economic and environmental benefits can be achieved and join the industry in a collaborative, concerted effort to have more aluminum beverage cans complete their circular journey, which the vast majority of the time is into a new can.”

The additional cans recycled from this effort will flow through an existing domestic circular economy. There are nearly 90,000 aluminum beverage cans recycled every minute in the United States, with 93 percent of those recycled cans going from the recycling bin back to store shelf as a new can in as little as 60 days. This high level of can-to-can recycling has resulted in the aluminum beverage can having an industry-leading average recycled content of 73 percent. Increasing the recycled content of the average can reduces its carbon footprint since making an aluminum beverage can from recycled material results in 80 percent less greenhouse gas emissions than making the container from primary material.

CMI members supporting the targets and financing the activities detailed in the roadmap are aluminum beverage can manufacturers Ardagh Metal Packaging, Canpack, Crown Holdings and Envases; and aluminum can sheet suppliers Constellium, Kaiser Aluminum, Novelis and Tri-Arrows Aluminum.

For more information on the targets and to access the roadmap and updates from the can industry on its progress, go to cancentral.com/targets.

_____________________

About CMI. The Can Manufacturers Institute (CMI) is the national trade association of the metal can manufacturing industry and its suppliers in the United States. The can industry accounts for the annual domestic production of approximately 130.7 billion food, beverage and general line cans; employs more than 28,000 people with plants in 33 states, Puerto Rico and American Samoa; and generates about $15.7 billion in direct economic activity. CMI members are committed to providing safe, nutritious and refreshing canned food and beverages to consumers in the most sustainable packaging.

Questions for Crown?